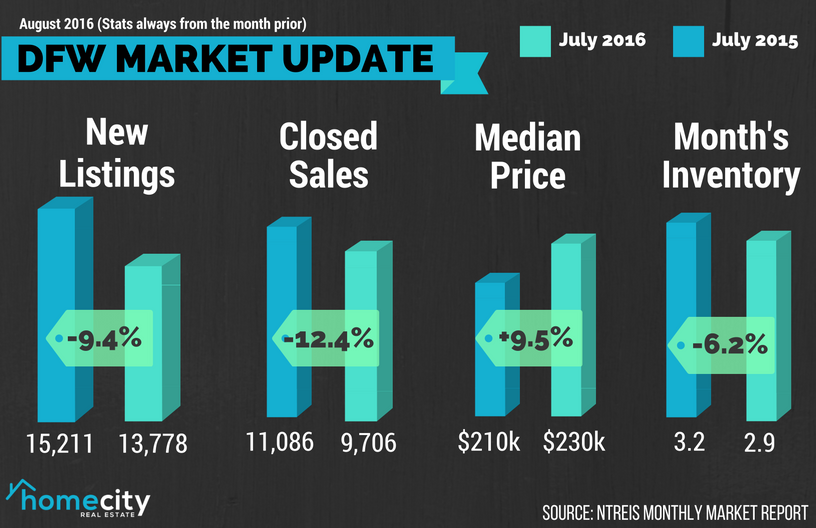

There’s a bit of a confusing atmosphere in the DFW area regarding real estate statistics. Prices continue to rise in many communities, yet homes are selling faster than they have in years. Buyers are needing to move quickly if they want to score their dream home, and often they will still need to pay over asking price. While this is mostly great for sellers, it also sometimes puts them in a situation where they are afraid that if they sell, they may not be able to buy a reasonably priced home in the more desirable areas once they close. For this and many other reasons, new listings went down in the DFW 9.4 percent to 13,778.

Inventory is becoming an issue, as there is a higher demand than supply. Inventory shrank 6.2 percent to 25,926 units in July 2016, according to North Texas Real Estate Information System’s (NTREIS) report. “With the increase in jobs and employees relocating to DFW, it creates a shortage in available homes for purchase,” says Aaron Duca, North Texas District Manager at Academy Mortgage. “This, in turn, increases the price of the homes that are for sale as high demand / low supply equals higher prices.”

As we reported in the first paragraph, the median sales price moved up 9.5 percent to $229,900. Still selling quickly, most homes spent 7.7 percent fewer days on the market, 36 days. This brings our months’ supply of inventory down 9.4 percent to 2.9 months. The Real Estate Center at Texas A&M cites 6.5 months as a healthy market, and we’re well below it.

“Builders have taken advantage of this opportunity and continue to buy up land to build on,” continues Duca. “We’re also seeing many people sell their current home to ‘cash out’ the equity, using some of these funds to buy a new home, and utilize the excess to either payoff debt and/or invest in long-term income strategies.” He advises you to consult with a financial planner if you plan to go this route.

Nationally, a low housing supply has prevented home sales from rising significantly despite the near-record mortgage rates we’ve been seeing. Unemployment is also under 5 percent which is some of the lowest we’ve seen in years. “The issue is not purchasing power,” NTREIS reports. “Many areas are falling behind last year’s closed sales totals simply because of lack of available inventory. As this continues, higher prices may put a deeper squeeze on the current buyer pool.”

Aaron Duca adds that, “The cost of home ownership includes the price you pay for the home and then your financing mortgage interest, annual property taxes, insurance and home maintenance. Just because one aspect (interest rates) are low, the overall cost can still be too high for potential buyers.”

What does this mean for potential homebuyers? You’re in a competitive housing market. This means homes are selling in a matter of days; there are fewer properties to choose from, and multiple offer situations are common. “It’s best to establish a family budget for rent/mortgage and back into what type of property fits into your budget,” says Duca. “With the rising property costs and associated tax increases, it’s best to buy while interest rates are low (now) to keep your total payment within your budget range.” A good Realtor® will be equipped to help you navigate this environment. We’ve also published a blog article outlining some of the pitfalls, and common ways our agents gain an advantage.