There has been a general slowdown in sales across the country, and this cannot be blamed on negative economic news. Unemployment remains low and wage growth, though nothing to overly celebrate, has held steady or increased for several years in a row. There is strong demand for home buying, emphasized by higher prices and multiple offers on homes for sale in many submarkets. As has been the case for month after month – and now year after year – low inventory is the primary culprit for any sales malaise rather than lack of offers.

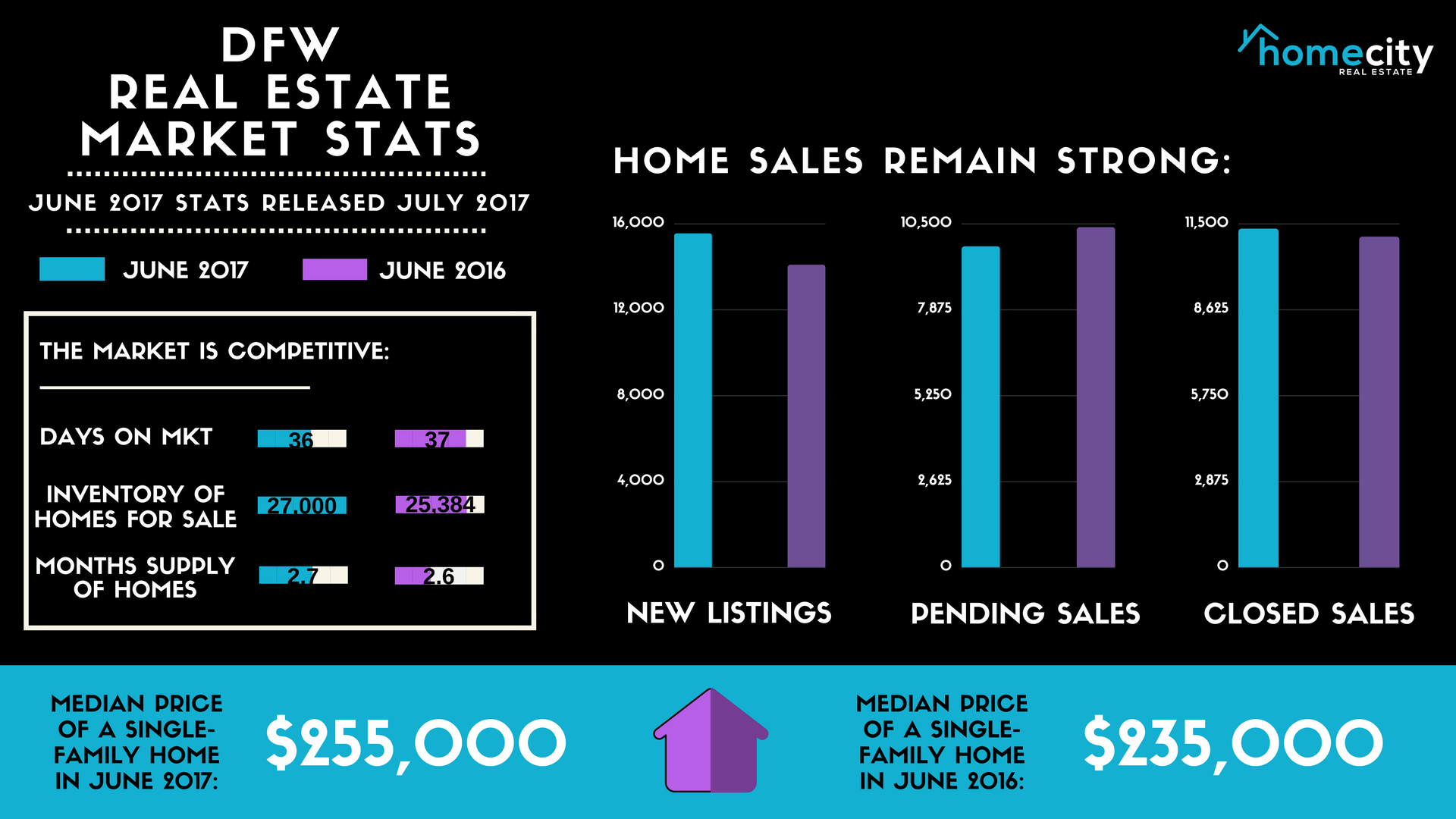

According to North Texas Real Estate Information System's monthly report, New Listings were up in the North Texas region 10.3 percent to 15,542, which can only help the current price situation. Pending Sales decreased 5.6 percent to 9,803. Inventory grew 6.4 percent to 27,000 units, another promising sign that home prices may normalize at some point in the future. Prices moved higher as Median Sales Price was up 8.5 percent to $255,000. While this might seem high compared to years past, DFW actually still has some of the most affordable real estate in the country. Days on Market decreased 2.7 percent to 36 days. Month’s Supply of Inventory was up 3.6 percent to 2.9 months, indicating that supply increased relative to demand.

With job creation increasing and mortgage rates remaining low, the pull toward homeownership is expected to continue. Yet housing starts have been drifting lower, and some are beginning to worry that a more serious housing shortage could be in the cards if new construction and building permit applications continue to come in lower in year-over-year comparisons while demand remains high. Homebuilder confidence suggests otherwise, so predictions of a gloomy future should be curbed for the time being.

In a D Magazine article written by Steve Kaskovich, Donald Ray Horton (founder of D.R. Horton Homes) shared his optimistic view. Horton says he’s committed to keeping homes in the DFW affordable, despite rising demand. In 2014, Horton introduced a new Express brand of homes for entry-level buyers, which accounted for 26 percent of sales with an average price tag around $204,600 last year.

Even though the feds plan to raise mortgage interest rates this year, Horton is counting on steady job growth and increased buying from millennials to drive home sales saying, “We wouldn’t have this number of units on the ground if we weren’t optimistic about the future,” he says.

As we stated earlier, there is no shortage of interest in home ownership in the DFW area. As more millennials enter the housing market this number is sure to grow. The Wall Street Journal reports that, “Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele.”

If builders can catch up to the demand for homes, we would say there is an extremely healthy housing market in our future.