It’s hard to ignore the rising home prices in our area, but what about mortgage rates? Economists predict mortgage rates will go up within the next year, but where are they heading and why is it important to buy now? We spoke with Jason Lewis from Supreme Lending about how increasing mortgage rates could mean potential buyers getting priced out of home ownership.

It’s hard to ignore the rising home prices in our area, but what about mortgage rates? Economists predict mortgage rates will go up within the next year, but where are they heading and why is it important to buy now? We spoke with Jason Lewis from Supreme Lending about how increasing mortgage rates could mean potential buyers getting priced out of home ownership.

People don’t realize how much mortgage rates directly impact a monthly payment. It’s incredibly important to understand how interest rates directly impact monthly payments, and why it’s important to look at where rates are headed when deciding to buy soon or wait. “There is a direct connection between the interest rate you are getting and the mortgage payment you will be making each month,” said Lewis. “An increase of a half a point in rates on a 30-year mortgage for a $200,000 home would increase your mortgage payment by over $60 a month or about 7%. A full point increase in rates (which is not out of the question at all) would be $120 or almost 15% increase in your monthly payment.”

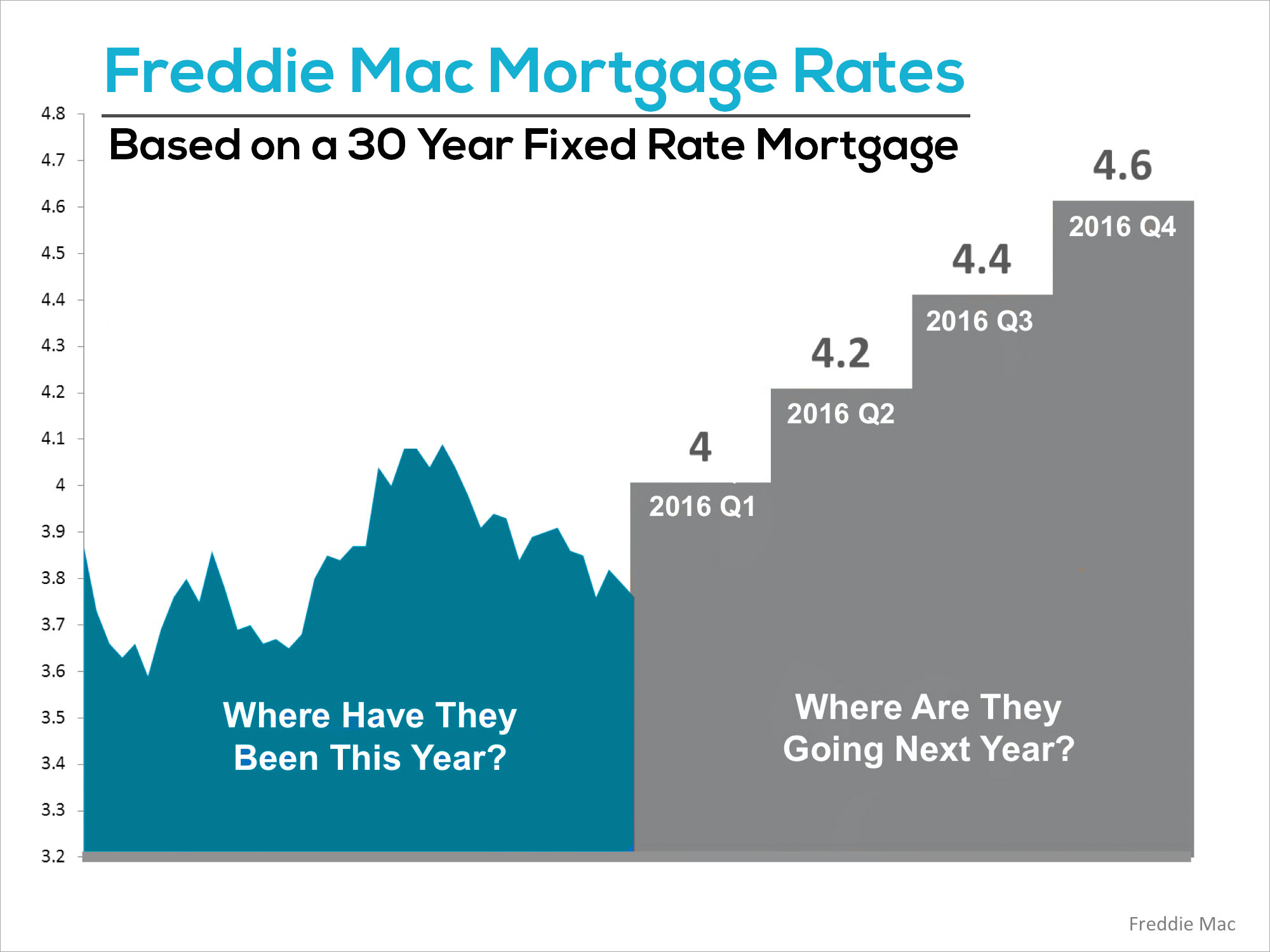

Currently, mortgage rates are holding steady but are predicted to rise steadily over the course of the next 12 months. Freddie Mac’s October 2015 U.S. Economic and Housing Market Outlook predicts more than half a point increase by the next year. “For some borrowers this is not a huge difference and when you look at the cost of renting it would still make sense to buy, even with higher rates,” said Lewis. “However, for many buyers this would be the difference between being able to buy or not. When you add in the fact that property prices are going up at the same time, you have a real problem.”

How much more would you end up paying next year with the rise in home prices and mortgage rates combined? “Let's say that same $200,000 house increased in value by only 5% in a year (which is a conservative estimate in our market). This would put the home’s price at $210,000 next year. Then you add in the mortgage rate possibly increasing from roughly 4% to 5%, and that same house is costing you about $200 more a month.” $200 more a month is enough to price some people out of home ownership.

According to CoreLogic’s latest Home Price Index, national home prices have appreciated 6.4% from this time last year and are predicted to be 4.7% higher next year. This is even more so in our areas, but when the market stabilizes, mortgage rates will rise. “I agree rates will continue to rise over the next year as the housing market continues to stabilize and the economy gains steam,” said Lewis. “The good news is that recent job reports tell us that things are getting better (if slowly) and as the economy does better and inflation starts to kick in, the government will raise short-term interest rates that will have an effect on mortgage rates.”

Economists have been predicting an increase for the last couple of years, and there are obviously many factors that play into whether or not this happens. “I know that it is inevitable that they will go up at some point, even if they don’t get much worse in the next year. It is a guarantee, here in Austin and DFW especially, that prices will continue to go up.” Why have they been at such historical lows for the last few years, though? “Rates have been kept artificially low by the fed with the short term lending rate at 0. It has already been said that this is definitely about to change. With that going up, mortgage rates are sure to follow. It’s just a question of how much.”

Owning a home has many benefits over renting. Lewis suggests that people interested in buying a home realize that, “even in a situation where the market doesn’t increase by the same year over year gains we have seen (10% +), buyers are still, so far, way better off gaining equity and having a great tax deduction.” It’s easy to forget that when you own your home you are investing in your future. “People compare what they can rent a house or apartment for to what they would pay on a mortgage, but you actually need to take into account how much you write off at the end of the year because of the house. Figure in what you are actually putting away in equity and saving for the future when weighing the pros and cons of buying vs. renting.”

There are so many factors involved in predicting mortgage rate fluctuations, but with home prices increasing the way they are it’s better to be safe than sorry. Folks sitting on the fence or waiting to become more financially stable before buying are urged to consider that this time next year they may be paying a considerable amount more for the same home they are eyeing today. Getting in touch with a good Realtor, as well as an experienced mortgage broker, can help those in doubt decide if it’s a good time to buy, or if it’s better to wait.