Demand has remained high throughout 2016, as predicted by most market specialists. This has caused sales and prices to remain high despite heavy reductions in inventory and months of supply across the country. Employment remains high, which is expected to keep sales levels high through the end of the year.

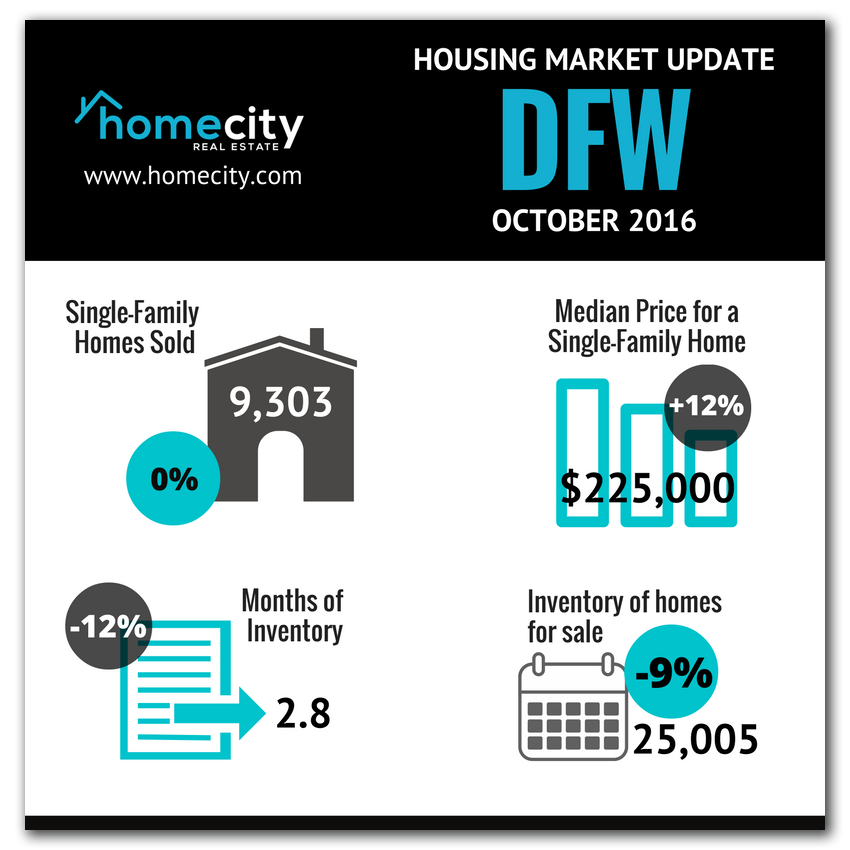

According to the North Texas Real Estate Information System’s (NETRIS) monthly report, closed sales stayed about the same in September 2016 as in 2015 at around 9,303 homes. Pending sales went down a whopping 10.2 percent however, and new listings rose 1.3 percent to 11,332.

Following trends around the rest of the country, inventory shrank 9.1 percent to 25,005 units. As the job market remains healthy, more and more people continue to move to the North Texas region. New homebuilders are having trouble keeping up with the influx, as we’ve seen for the last couple of years. Supply and demand dictate that this means prices will rise.

This demand is generally driven by three factors: Millenials who are reaching the age where they want to buy a home, growing families “moving up” to larger homes, and empty nesters downsizing. Low-interest rates are encouraging buyers, but at the same time, encouraging would-be sellers to refinance instead of listing. This, in turn, contributes to low inventory and less supply.

Indeed, the median sales price went up 12.5 percent to $225,000. Keep in mind, however, that this is still very low compared to other desirable areas of the country. For example, home prices just south in Austin, Texas are sitting at $345,000! For further comparison, in California, the median price for a single-family home sits around $472,100 (and that’s considering the whole state – Las Angeles and San Francisco areas are much, much higher).

Days homes spend on the market have decreased 2.5 percent to 39 days, further enforcing the notion that the market is extremely competitive. Month’s supply of inventory was down 12.5 percent to 2.8 months, which is well below what the Texas A&M Real Estate Center cites as a balanced market (6 months).

This is great news for sellers, who are getting 96.9 percent of their original list price on average, that’s .3 percent more than September 2015. Unfortunately for buyers, the housing affordability index has gone down 8.5% to 150.

Does this make the market unhealthy? Not necessarily. In a mid-year article, DallasNews.com reported that the DFW area ended up on Nationwide Insurance’s most unhealthy markets list. “Clearly the whole Dallas Metroplex is way too expensive relative to income,” said Nationwide economist David Berson. “I can’t imagine you can sustain these kinds of price increases without significant harm to the housing market.”

“It’s a good thing there is a lot of job growth there,” he said. “That offsets a lot of the negative impact of higher prices.” Berson said both Dallas and Austin’s home markets show no sign of slowing because of declines in the Texas energy sector. Other Texas cities have seen big housing setbacks because of oil industry layoffs.

It looks like, for now at least, the market in the DFW area will remain competitive, with buyers scrambling to win the best properties. Now, more than ever, it’s imperative to enlist the help of a knowledgeable, well-connected real estate professional.