The median price of a single-family home reached an all-time high of $407,400 in the city of Austin—setting a new record for the Austin Board of REALTORS®’s monthly housing reports. But at the same time, the May 2019 Central Texas Housing Market report shows declines in the city of Austin for both new and active listings, as well as a 3.4% drop in home sales. The same wasn’t true, however, for the surrounding areas, which all experienced strong gains.

"A lack of middle-market housing in the city of Austin is driving demand to the suburbs," Kevin P. Scanlan, 2019 president of the Austin Board of REALTORS®, said. "While the Central Texas housing market is healthy and thriving, Austin continues to struggle with housing options that are affordable for first-time homebuyers as the median price surpasses $400,000."

Such escalating prices have taken a toll on the Austin Independent School District, where the city’s lack of affordable housing and the increase in multi-family developments “has negatively impacted the school district's projected growth,” Reyne Telles, the district’s executive director of communications and community engagement, said.

"As more families move outside the district's boundaries, we’re taking the appropriate steps to mitigate this trend,” he said. “In order to adapt to this new reality, and work towards increasing our student population, the school district now allows students who reside outside of AISD's boundaries to transfer into our schools.”

Austin-Round Rock MSA

In the Austin-Round Rock MSA, single-family home sales in May increased 6.2% year over year to 3,452 home sales as sales dollar volume experienced a double-digit percent increase of 14.8% to $1,468,980,773—the highest volume to date. The median price for single-family homes rose 4.2% to $335,095. However, during the same period, new listings slightly decreased 1.3% to 4,356 listings and active listings decreased 0.6% to 6,781 listings. Pending sales increased 8% to 3,504 pending sales. Monthly housing inventory declined 0.1 months year over year to 2.6 months of inventory.

City of Austin

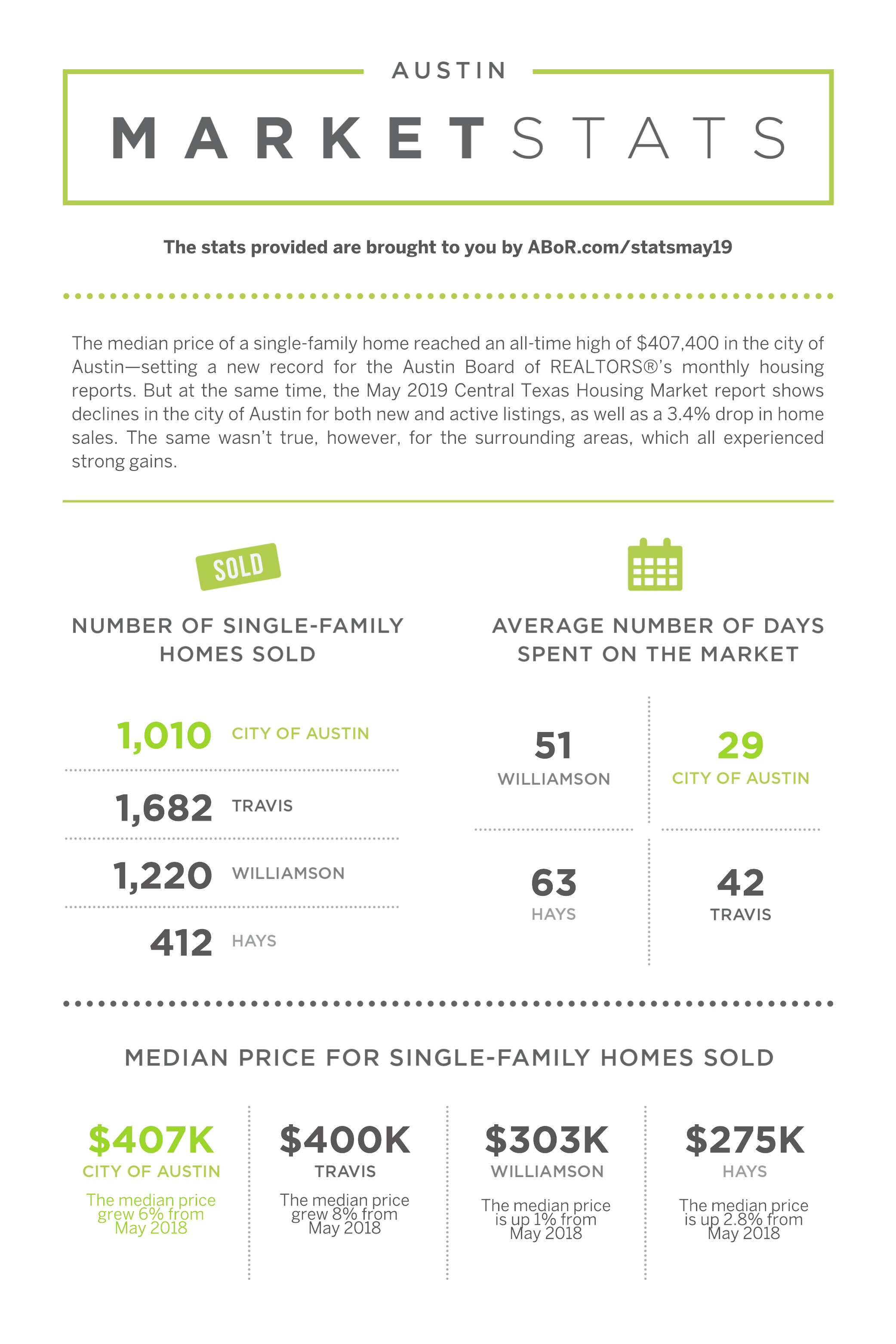

Single-family home sales decreased by 3.4% in May to 1,010 sales in the city of Austin. However, sales dollar volume increased by 7.1% to $512,126,547, illustrating higher price points and a tightening market. The median price for single-family homes rose 5.8% year over year to $407,400. During the same period, new listings decreased 3.6% to 1,263 listings; active listings decreased 11.3% to 1,349 listings, but pending sales increased 3.3% to 1,009 pending sales. Monthly housing inventory decreased 0.2 months year over year to 1.7 months of inventory.

Travis County

In Travis County, single-family home sales increased by 2.9% to 1,682 sales in May. During the same period, sales dollar volume spiked 16.5% to $884,454,751. The median price of single-family homes increased 8.1% to $400,000. New listings decreased 4.7% to 2,126 listings and active listings decreased 7.3% to 2,977 listings, as pending sales increased 3.6% to 1,713 pending sales. Monthly housing inventory dropped 0.2 months to 2.3 months of inventory.

Williamson County

Williamson County single-family home sales increased 8.4% to 1,220 sales and sales dollar volume increased 8.3% to $400,430,598. The median price for a single-family home in May rose year over year by 1.1% to $303,323. During the same period, new listings increased 3.2% to 1,508 listings. Active listings remained flat at 2,335 listings. At the same time, pending sales experienced a double-digit increase of 12.4% to 1,217 pending sales. Housing inventory decreased 0.1 months to 2.5 months of inventory.

Hays County

In Hays County, single-family home sales increased 10.2% to 412 sales in May and sales dollar volume rose 16.9% to $145,394,941. During the same period, the median price for single-family homes barely rose—0.4% to $275,969. New listings slightly increased 0.8% to 520 listings and active listings increased 6% to 977 listings. Pending sales jumped 14.9% to 425 pending sales. Housing inventory increased 0.1 months year over year to 3.2 months of inventory.